Dinie

2013 ·

Visit website

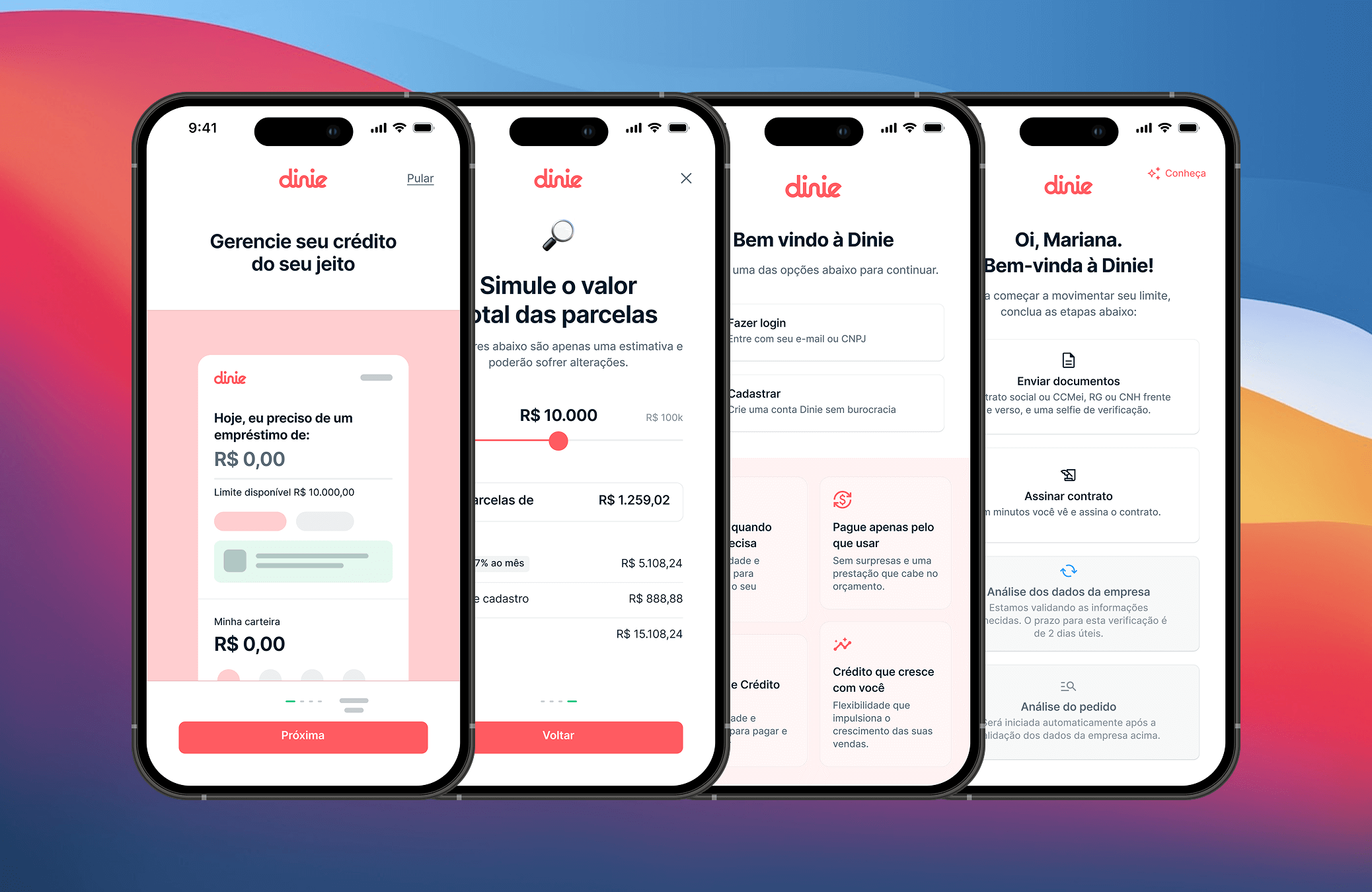

Product Designer. Dinie is a fintech platform that powers instant

credit and B2B payments for SMBs in Brazil, partnering with

leading digital platforms to drive financial inclusion and growth.

Roles

Product Design, UX/UI, Product Strategy, User Research,

Onboarding, Prototyping, User Flows, Front-end Alignment.

- Led the redesign of Dinie’s onboarding experience, enabling embedded credit solutions to scale with better usability and adoption.

- Conducted user interviews, behavioral analysis, and data exploration to identify friction points and define the optimal onboarding flow.

- Delivered a complete UX and UI redesign that aligned business needs with user behavior, focusing on clarity, trust, and conversion.

- Created responsive, accessible design patterns and collaborated closely with developers to ensure high-quality implementation.

- Synthesized findings from both qualitative and quantitative sources to iterate quickly and deliver a cohesive, conversion-optimized experience.

Goals

- Streamline the onboarding flow to minimize user drop-off and ensure faster time-to-value.

- Strengthen trust in Dinie’s brand by offering a modern, transparent and efficient user journey.

- Design for scale, supporting multiple platform integrations and different user profiles.

- Create a system that could evolve and adapt with Dinie’s roadmap and client base.

Process

-

Discovery & Research

Interviewed key platform users and analyzed onboarding funnel metrics to identify usability gaps and business blockers.

-

Journey & Flow Mapping

Mapped frictionless entry points across partner platforms, credit eligibility validation, and user verification flows.

-

Wireframes & Prototypes

Designed wireframes and interactive prototypes to simulate critical moments of the onboarding journey.

-

Final Design & Handoff

Delivered polished UI with consistent component logic, accessibility standards, and full documentation for development.

-

Validation

Conducted usability tests and implemented iterative refinements based on real usage data and user sentiment.

Impact & Results

- Improved conversion rate significantly by simplifying complex onboarding requirements.

- Reduced user drop-off during onboarding by introducing clearer steps and guidance.

- Enabled embedded lending at scale with a modular onboarding flow adaptable to different partner platforms.

- Aligned product design with regulatory and business constraints, allowing safe and fast credit activation.

- Helped Dinie scale instant B2B credit access for SMBs across Brazil, supporting financial inclusion.

Let’s talk about our next project.